Originally seen HERE.

As real estate brokers, one of the most frequent questions we field is “how much is my property worth?” The value of each property can vary depending on who is considering it—the owner, the lender and the buyer, as well as other entities involved in the financial life of a property, may all have a different perception of value. The fair market value of a hotel is defined as the price at which a willing purchaser and a motivated seller agree.

Coming to an agreement is a large hurdle in hotel dispositions and can produce roadblocks throughout the process if any party’s perception of value differs. Brokers will help a seller analyze what the fair market value is in preparation for listing by looking into the subject property’s specific performance, the market and location, and a comparison of what properties in the market have sold for recently.

Value Based on Property Performance

Due to the fluctuating nature of the hotel business, the most common way brokers will evaluate your property is based on current performance, while considering past results and future potential. Employing a room revenue multiple and a capitalization rate based on your net operating income are the most straightforward mechanisms for determining how much your property is worth based on actual property performance.

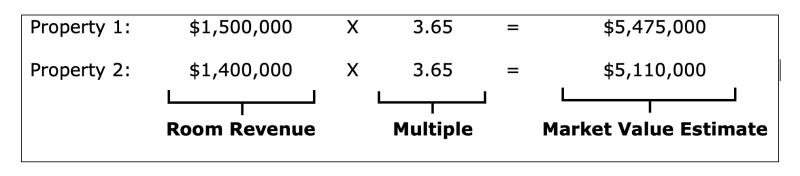

When considering a room revenue multiple, the gross room revenue at the end of a 12-month financial period is multiplied by a market-generated multiple. The typical range for the room revenue multiplier is three to five times, but it may vary more depending on current market conditions and the class of property being considered. This valuation tool is widely used on mid-market and economy hotels in secondary and tertiary markets, but generally not for full-service resorts or central business district assets, as they are more complex and generally based on a capitalization rate.

As a quick example below, imagine two similar hotels with slightly different room revenues. They may require the same room revenue multiple based on the average RRM of similar sales in the market, but have different market value results:

A high room revenue multiple signifies that a property trades higher proportionately to room revenue and generally corresponds to hotels of higher scale-classes, located in a larger market, fully renovated, or even when there is significant upside to the operating performance to the property. A lower room revenue multiple is more likely to be used in lower-scale hotels in smaller markets or requiring larger capital expenditures. As a seller, of course one wants to list their hotel at the highest possible room revenue multiple to maximize the sale price. From another perspective, a hotel buyer always prefers to purchase a hotel with a lower multiple, which maximizes their upside while minimizing their up-front cost. In many cases, the final transaction is closed somewhere in between.

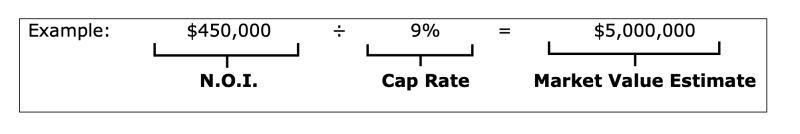

Cap Rates and Net Operating Income

A capitalization rate, or simply cap rate, may be more effective for assets with multiple streams of revenue as the net operating income considers all revenue streams and how much income remains to cover debt service and other capital expenses. To arrive at the market value using a cap rate, the net operating income is divided by an appropriate percentage: the capitalization rate.

Calculating a capitalization rate requires a formula that considers equity injection, required rate of return on equity, debt injection, and cost of debt; most buyers utilize cap rate averages based on hundreds of transactions over years in the market instead. Not all buyers or industry professionals will agree on what cap rate to use on a given property, as some of the factors vary person to person.

To make matters simple, sales with a lower cap rate provide a higher annual rate of return relative to the market value of the asset. Hotel cap rates typically range from 7.5 percent to 12.5 percent. The lower end of the range is typically representative of transactions of “investment quality” assets: high-end hotels in primary markets which are likely to be long-term investments. The upper end of the range is typically representative of transactions of “owner/operator” type assets. These may include economy or midscale properties in secondary markets that are not likely to be operated by third-party management as a long-term investment.

Price Per Key

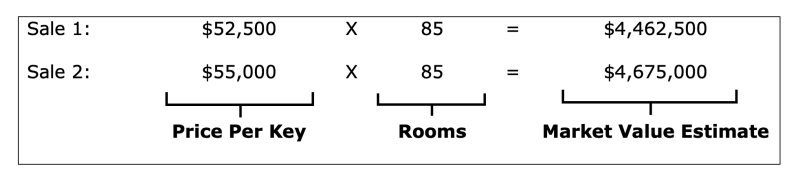

There is only so much a single property’s performance can tell us about market value, without considering the broader market surrounding it. After considering what a likely fair market value is based off the subject’s performance level, a broker will investigate recent sales of similar properties in the market (or similar markets in the state, region or country). In the sales comparison approach, the subject hotel is compared to the sales price of similar hotels, frequently on a price per key basis. Properties can be compared based on market, hotel flag, size and structure of the property, number of rooms, age, and the cost of required renovations, just to name a few.

To illustrate the idea: Nationally franchised properties in the mid-scale and limited-service asset classes located in similar high volume, transient markets tend to trade within a defined price-per-key range. It is a range because market value is subjective and is ultimately determined by location, condition, and performance—each of these differ asset to asset. The number of rooms at the property is multiplied by a market generated price-per-key average (or range) of similar assets that have sold in recent years. As an example, there were two comparable sales of similar assets in the market recently:

After analyzing parameters related to the property’s location, condition, performance and asset class, a real estate professional can estimate that an asset’s market value is likely to lie within a certain price range. This price range can vary widely depending on the market, location within the market, physical plant, PIP estimate, hotel operating model, and several other factors, which is why it’s important to work with a professional who is well-educated on the market and subject property.

As there are multiple methods to arrive at a property’s market value, most real estate professionals offer a broker’s opinion of value when assisting a client in the sale of their hotel property. Because the fair market value of a property is fluid, the best way to ensure an accurate value is to use current data on the subject and recent comparable sales as supporting evidence. In theory, and in practice, using a room revenue multiple and/or a cap rate, one should arrive at the same fair market value as he or she would utilizing the comparable sales approach. It’s important to work with a professional who is up to date on market trends and recent transactions to get the best idea of your hotel’s market value.